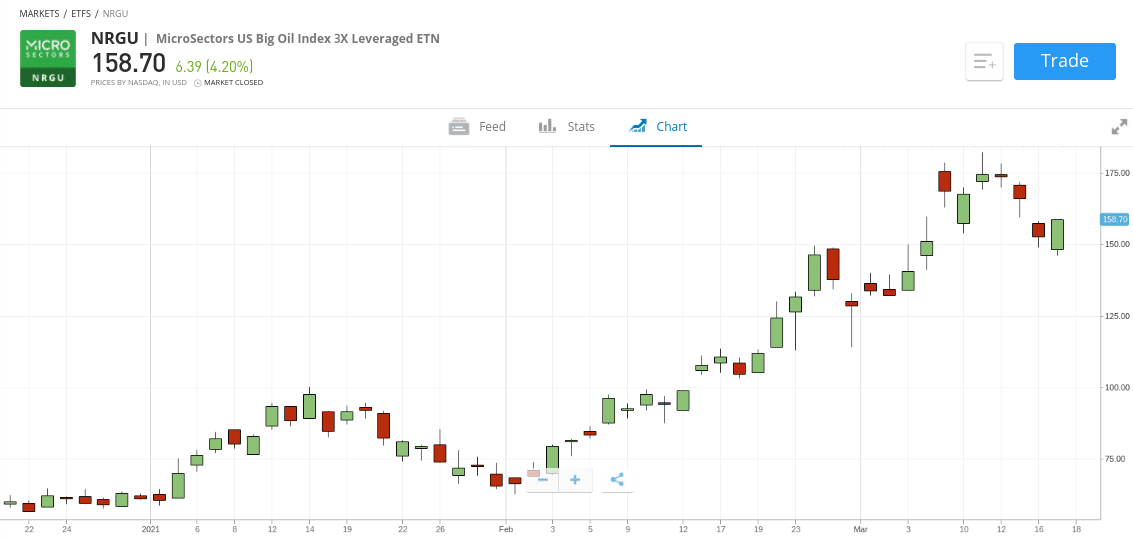

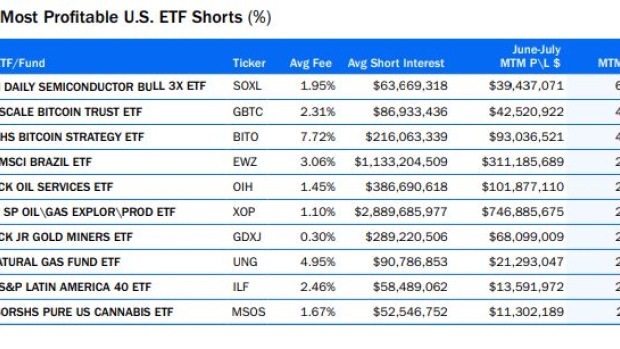

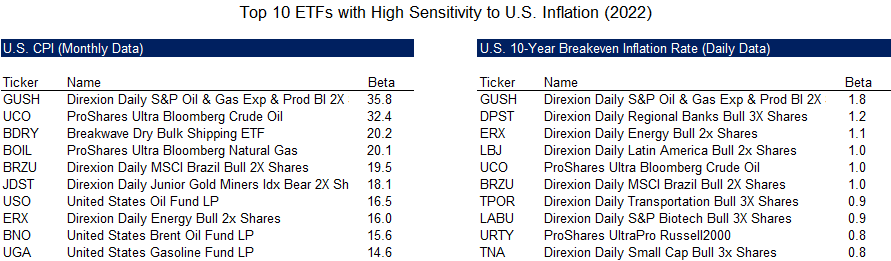

The MicroSectors U.S. Big Oil Index 3X Leveraged ETN Offers A Good Way To Bet On A U.S. Oil Miners Recovery (NYSEARCA:NRGU) | Seeking Alpha

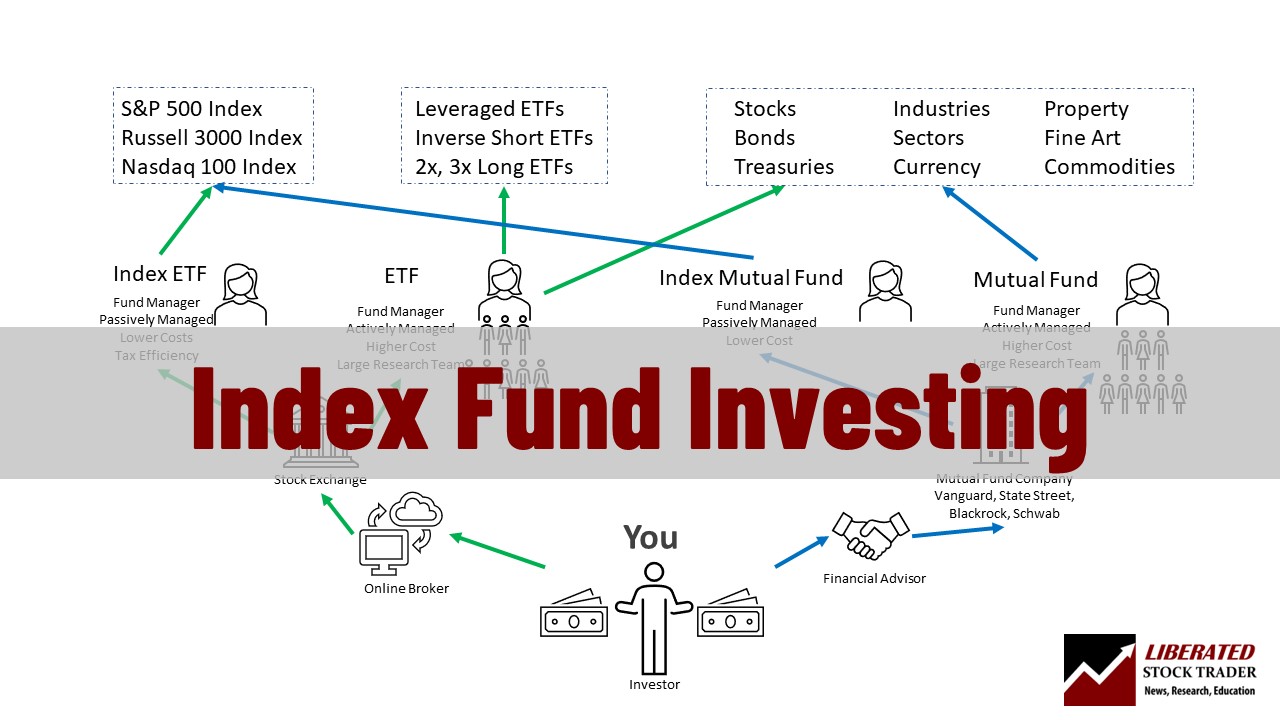

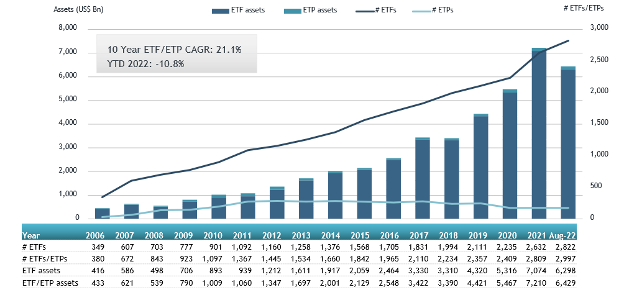

ETFGI reports the ETFs industry in the United States gathered US$43.18 billion during August 2022 | ETFGI LLP

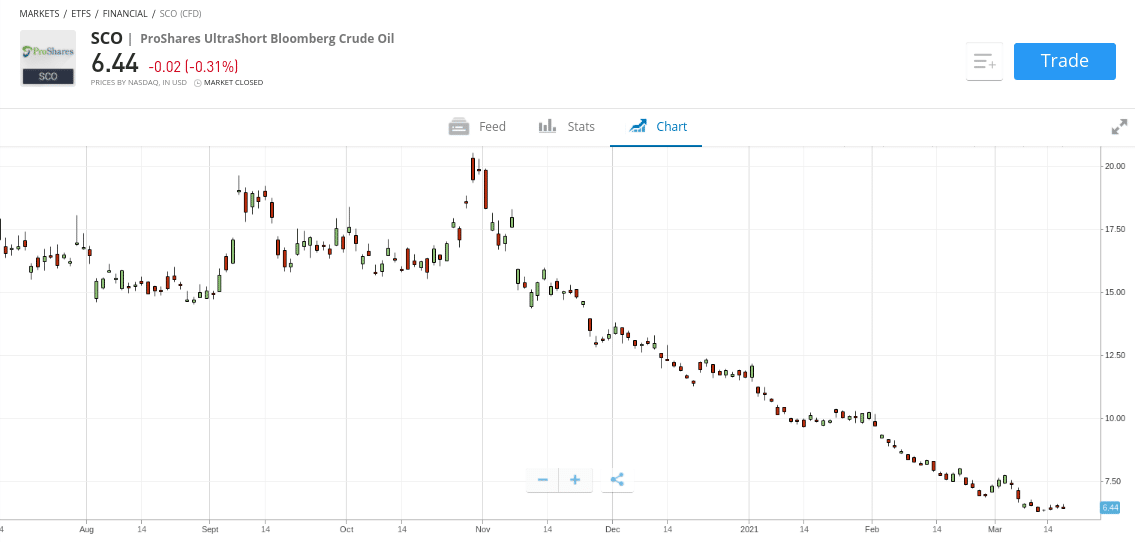

USCF Announces Options Trading on the United States 3x Oil Fund and the United States 3x Short Oil Fund (NYSE Arca: USOU, USOD)

:max_bytes(150000):strip_icc()/close-up-of-an-oil-platform-at-sea-574901535-596e7b460d327a0010f04164.jpg)

:max_bytes(150000):strip_icc()/MajorOilCoETFs_GettyImages-2dc580d2164e4329a7dfc71369045f72.jpg)